The Opinionated Ogre is a Stay-at-Home parent first, foul-mouthed hater of fascist Republicans second. He’s been making the most horrible people in the country miserable for over 15 years, and the hate he feels for American Nazis is eternal and without limits. He plans to stop torturing right-wing trash the day the last fascist dies. So, you know, never. Please help support this potty-mouthed newsletter for just $5/month or $50/year (Almost 17% less!)

It’s been a little over a week since we started to bomb Iran for “reasons.” Maybe it was because Trump had a “gut feeling.” Maybe because several Gulf states poured literally billions in bribes into the pockets of Trump, his family, and various members of the regime. Maybe because Russia ordered its favorite puppet to start a war. Maybe because Stephen Miller and Trump thought they would be able to use the war to finish their authoritarian schemes on America.

It’s becoming clear to the regime that they’ve made an enormous mistake. An enormous and fatal mistake, and they’re not quite sure what to do about it.

It probably seemed like a good idea at the time.

The regime would pay back all of the bribes it’s received. Jared Kushner, alone, got $2 billion. The Trump family has been paid so much in crypto, we’re not even sure how much they’ve sold our military for at this point.

Russia would get an enormous boost in oil profits and, gee whiz!, would you look at that? We’re lifting sanctions so countries can buy Russian oil! Boy! That sure is convenient for a country whose economy was on the brink of collapse just a few weeks ago.

The Evangelicals are thrilled, of course. This just might be the End Times! March on, Holy Crusaders!!!

This was going to be a quick and easy war. We would go in, blow everything up, kill the Supreme Leader, topple the government, and make Donald Trump look like a manly war hero! Iran, of course, would fight back just long enough that we would have to declare a “national emergency” and federalize the elections ahead of the midterms. Very sad. Hate to do it, but it’s for the best.

But it’s nine days later, and Iran hasn’t surrendered. Those fuckers selected a new Supreme Leader! They’re still fighting back! They’re killing people all across the Middle East and wreaking havoc! What the fuck?!

This was supposed to be over already! Trump was supposed to be rolling down Pennsylvania Ave. by now, enjoying his awesome victory parade and the praise of the people!

Instead, most of the country is furious with him, including a growing part of his own base. What? Did those fucking imbeciles really believe Trump when he said, “No more foreign wars?!” He’s lied about everything else, and NOW they’re surprised he lied about that, too?! WhatEVER!

And what is all this bullshit about running out of missiles?!

In a closed-door meeting with lawmakers Tuesday, Defense Secretary Pete Hegseth and Chairman of the Joint Chiefs of Staff General Dan Caine reportedly said that Iran’s Shahed attack drones had proved a more difficult problem than initially predicted.

One source told CNN that the U.S. has been “burning” through long-range precision-guided missiles.

You mean we can’t make expensive, complicated missiles as quickly as cheap and relatively low-tech drones?! Drones that Iran has been stockpiling explicitly for this exact moment? How could anyone have foreseen such a thing? Except maybe the experts who warned that this is exactly the war Iran would fight?

A quick aside here: It’s important to understand that Iran is not fighting to win. It can’t, and they know it. This is a war of survival. What does that look like for Iran? Causing so much pain and suffering and damage to every hostile country in the Gulf that they demand the United States and Israel stop the attack. If we run out of interceptors and Iran can start launching drones that we can’t stop, the damage will be extreme. Ask Ukraine. The Gulf states will not put up with that crap for long. They wanted us to do their dirty work for them, not have death rain on their countries for weeks on end.

A second consideration for the regime is what happens if we DO run out of munitions. We’re the United States. The most fearsome and dangerous war machine ever to exist yadayadayada. If we literally run out of missiles, we suddenly look a whole lot less fearsome and dangerous. Ask Russia what it’s like to have your reputation as a military superpower evaporate.

Did you know the Opinionated Ogre has a weekly podcast? It’s true! New episodes every Thursday! Catch the latest episode here:

Meanwhile, Trump is ordering the peasants to stop paying attention to the price of gas. No, really.

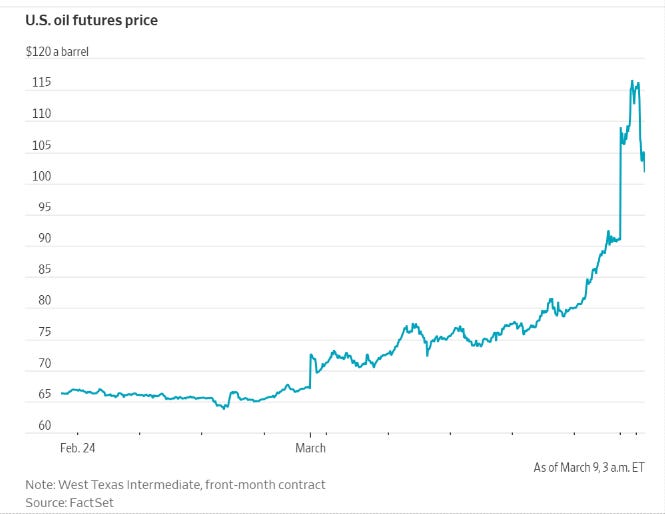

What’s the price of oil looking like right now? Well, it’s 3:20 in the morning EST1

That drop from $115 a barrel is, if I understand it correctly, because countries are talking about releasing oil from their strategic petroleum reserves. That, however, is a stopgap measure. If the war drags on and oil production continues to be strangled in the Gulf, prices will skyrocket well past $100 and stay there.

And since Israel will not stop until Iran is crippled, permanently, this war is only just beginning. There’s a reason Trump is talking about sending troops in. If he backs out now, without toppling the regime, he’ll look weaker than ever. Of course, toppling the regime will be almost impossible according to our own intelligence experts:

Israel, of course, doesn’t really care, and they’re destroying everything: Schools, hospitals, desalination plants in a country suffering from acute drought. Israel is also blowing up oil infrastructure, which is causing widespread ecological damage, essentially waging chemical warfare by proxy. It’s also ensuring that the price of oil will spike further as the markets panic over the destruction of a major oil supplier. It’s also very likely to make the Iranian people turn towards their repressive government to protect them from the violently insane invaders attacking them. Remember “Hearts and Minds?” This is what the opposite of that looks like.

What could possibly go wrong?

So we’re stuck fighting a war we can’t get out of with objectives we cannot complete, and the longer we fight, the more damage to our own economy we do. An economy that is already teetering on the edge of collapse, just waiting for one or two more pushes to go over the edge.

We lost jobs in December and February. Unemployment is up. A sharp spike in gas and oil prices will push inflation way back up and drag the economy down like an anchor.

Here’s another terrible indicator that no one is really paying attention to (which is why you have me). I’ve been talking for a while now about two different bubbles, AI and the fucking banks AGAIN!!!!

In 2008-2009, the banks collapsed because they had hundreds of billions in bets tied up in mortgages that went bad. Did they learn their lesson? Fuuuuuuck no.

Well, sort of. Now they’re not just betting on mortgages. They’re betting on all kinds of debt. Credit cards, auto loans, grocery loans. Anything you can borrow money to pay for, they’re betting money on it. What happens when the economy sours and those loans default? The same goddamn thing that happened in 2008-2009. The banks can’t pay their debts, and the bubble pops. Boom goes the economy.

And look at that, rich people are starting to panic about their money:

Sentiment has soured around private credit in recent months, and retail investors are increasingly asking for their money back from funds like BlackRock’s $26 billion HPS Corporate Lending Fund (HLEND), which were designed to be open to wealthy individuals.

“It should serve as a warning sign for the industry and the rulemakers about the downside of illiquid funds for retail investors,” said Greggory Warren, senior stock analyst at Morningstar.

Last year’s bankruptcies of a U.S. auto parts supplier and a subprime auto lender, along with the collapse of a UK mortgage lender last week, have raised questions about lending standards.

“Subprime auto lender.” That’s literally the same scummy thing the banks did with mortgages, and for the exact same reason. More loans mean they can be bundled into “financial instruments” and used to place bets. Bets that are starting to go bad with predictable results. Fuck these people with a red-hot poker.

What’s an aspiring dictator to do when his quick and easy war turns out to be a quagmire that will make it impossible to win an election he cannot afford to lose? Worse, Trump’s dreams of riding high as a warhero and/or declaring a national emergency are dependent on public support. He’s so reviled, no matter how hard the regime tries to terrorize the country into submission, we are not going to play along.

Whether Iran manages to land a real terrorist attack or the regime (or Russia or American Nazis) stages a false flag attack, it won’t matter. The public is going to blame Trump and his stupid fucking war. The LAST thing we’re going to do is give him more power. “Please protect us from the fucking mess YOU made!” Yeah, that is not going to happen, no matter how much Stephen Miller masturbates himself to sleep dreaming of his own personal Reichstag Fire.

By attacking Iran in such a sloppy, stupid, and thoughtless way with no goals and no exit strategy, Trump has guaranteed the blue wave that was already coming will be an unstoppable flood washing away hundreds of corrupt Republicans up and down the ticket across the country. The House is lost. The Senate, once seen as a heavy lift, is now slipping out of the reach of the GOP. State legislatures and governorships are threatened. All of this two years before an election that will determine the fate of hundreds of Republicans facing life sentences in prison under a Democratic president with a real Attorney General.

If you thought Trump was desperate already, you ain’t seen nothin’ yet as the full realization sets in of just how much he’s fucked himself. I’d be more worried if there was a single competent fascist in the White House, but it’s a fucking clown show through and through. They’ll hurt a lot of people as they flail and sink. Our job is to keep them from pulling us under with them. Or rather, push them under and hold them there until they stop moving. Just to be safe. 😜

I write to help you cope with the fear and anger threatening to overwhelm you every day. If this newsletter gets you through these dark times, please consider becoming a contributing supporter for only $5 a month or just $50 a year (a 17% discount!). Thank you for everything!

There are only 277 days until the midterms, and the regime is panicking. They’re afraid of us. Keep making them afraid every single day. Remember, you are never alone. We beat the fascists once. We will fucking do it again.

1

I am having an astonishing bout of insomnia and want to claw my eyes out. I am, instead, writing an article for you. How’s THAT for dedication?