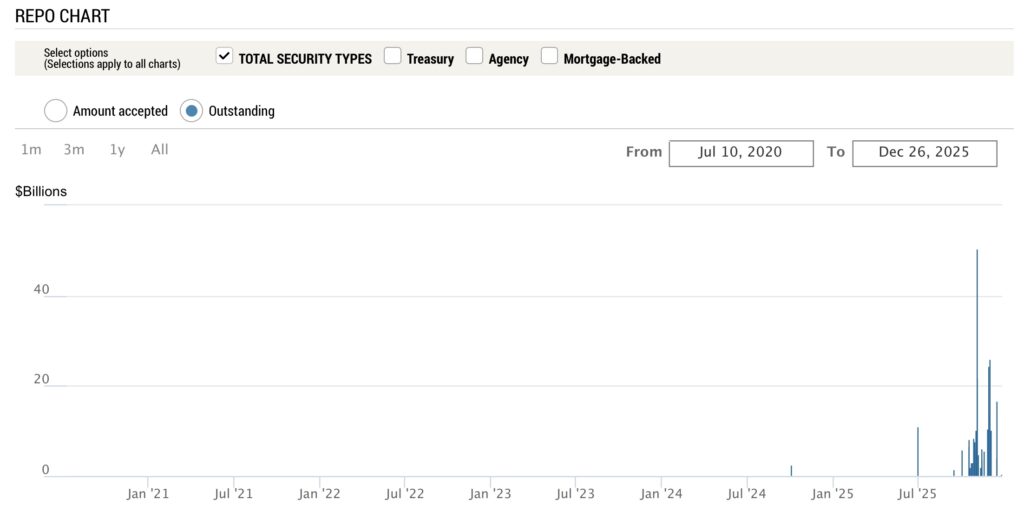

Just days after DCReport revealed the New York Fed quietly removed caps on emergency lending, the central bank injected another $34 billion into Wall Street—amid rising turmoil in precious metals markets.

On Sunday evening the New York Federal Reserve made another gigantic infusion of cash into one or more Wall Street banks.

On Monday DCReport revealed that after going more than five years with little to no cash infusions from the New York fed, one or more of the big Wall Street banks has been requiring gigantic infusions of cash since Halloween. On the day after Christmas at 8:00 in the morning there was a $17 billion cash infusion, our economics correspondent James S. Henry discovered.

Things have taken a turn for the worse.

On Sunday December 28th at 5 PM, when banks are closed, the New York Fed infused one or more Wall Street banks with $34 billion of cash.

Soon after, the Chicago Mercantile Exchange tightened requirements to speculate in silver and gold. The CME, as it’s known to traders, said this was a routine action to make sure the silver and gold markets remain liquid and firm.

The CME said the tightening was in response to volatility in the market for those two precious metals. That announcement went to subscribers to its alerts and was not reported, as best we can tell, in major press reports.

Cash infusions to banks are a standard operating practice. Sometimes banks get short on cash. But from early July of 2020 until Halloween there were virtually no such deals by the New York Fed helping Wall Street banks.

Then, in a scary move, one or more of the banks got $51 billion of cash on Halloween. The cash infusions from Friday and Sunday also equaled that amount. These huge cash infusions come after the New York Fed lifted the caps on how much the banking industry can get in emergency cash infusions.

The NYFed’s poorly worded Dec. 10 announcement went unreported by major news organizations.

At DCReport we think it’s an ominous sign that the NYFed is expecting more and larger cash calls soon. Why else would it make such a policy change?

The New York Fed does not disclose which banks benefit from these cash infusions, but people who follow precious metals markets and other speculative moves have been pointing for weeks to JP Morgan, the nation’s largest bank. One of JP Morgan’s units disclosed that it sold about 5,900 tons of silver it does not own in what’s known in the trade as a “short sale.”

Just as you can make money by buying something and holding on to it in the hope the price will rise, speculators can also do the opposite.

If you think the price of a commodity or any other assets are going to fall you can sell it at a high price hoping to buy it back at low price and profit off the price drop. The trading desks at the big banks do this by borrowing shares they don’t own or in some cases making “naked” sales of shares they don’t have at all.

The danger in a short sale is that if the price goes up there’s no limit to how much money you can lose.

Since the beginning of the year the price of silver has roughly tripled. That means those who sold short last year are in a squeeze and face cash calls that must be answered the same day if the price of silver or gold rises.

Christmas week the price rose to more than $84 on one of the metals exchanges and then fell 15% to a less than $72 a troy ounce. On another exchange the price didn’t rise quite as high before it fell 11.5% on the last day of 2025.

The concern here is not that the Fed can, and from time to time does, infuse banks with cash to cover shortfalls. It does this through a mechanism called a Repo in which the bank puts up collateral to cover the cash infusion. The rules include a sophisticated shield from federal Bankruptcy Court filings and with super low interest rates.

The issue is that after five years and three months with virtually no such cash infusions there’s suddenly a spate of them, three of them gigantic.

The Fed in New York has removed limits on the amount of cash it will provide the banking industry, although it is limiting individual banks to between $80 billion and $240 billion per day, depending on how you read its announcement.

Add the fact that the Chicago Mercantile Exchange, after reviewing silver and gold market volatility, tightened up on speculation in silver and gold and these are clear early warning signs of trouble.

The last time we saw big cash shortfalls on Wall Street we saw the collapse of the economy in 2008. By some measures the Great Recession was more damaging and more enduring in the harm it caused than the Great Recession that began in 1929.

Families whose head was 35 or younger in 2008 were essentially wiped out financially. Research by a California business school professor says the effect has been to wipe out the economy – the equivalent of two full years of all the economic activity in the U.S. since 2008. This means America is tens of trillions of dollars behind where it would be but for the misdeeds of Wall Street financiers during the George W. Bush administration, which basically let bankers ignore long established banking practices to minimize risk of systemic failures.

We still haven’t seen a word about this in any major publication that covers Wall Street.

Jim Henry and I know from experience that many of the journalists who cover Wall Street are masterful at developing sources and explaining what they’re told, but unlike DCReport they don’t routinely scour public disclosures, and they don’t have a deep understanding of the law and banking regulations, making them captive to their sources.

We also have yet to hear back from JPMorgan, five of whose spokespeople we reached out to for their side of this story. If and when they do reply, we will give you a full report of their stance.

Why This Matters

-

Emergency lending is a stress signal.

Repo operations are routine—but sudden, repeated, and massive infusions after years of inactivity suggest acute liquidity strain, not normal operations. -

The caps were lifted for a reason.

Regulators do not remove limits on emergency funding unless they expect bigger and more frequent cash calls ahead. -

Market volatility can trigger same-day crises.

In commodities trading, losses—especially from short positions—can generate same-day margin calls with no grace period. -

Precious metals are flashing warning lights.

A rapid run-up in silver prices increases the risk of unlimited losses for short sellers, forcing urgent cash demands. -

Opacity raises systemic risk.

Because the New York Fed does not identify recipient banks, markets—and the public—cannot assess who is exposed or how concentrated the risk may be. -

History offers a cautionary tale.

The last time Wall Street faced cascading liquidity shortfalls, it preceded the 2008 financial collapse, whose economic damage is still felt today. -

Silence from major outlets matters.

When sweeping policy changes and emergency actions go largely unreported, early warning signals can be missed—until consequences spill into the real economy.

“FREEDOM OF THE PRESS IS NOT JUST IMPORTANT TO DEMOCRACY, IT IS DEMOCRACY.” – Walter Cronkite. CLICK HERE to donate in support of our free and independent voice.

The post After ‘Unlimited’ Cash Shift, New York Fed Pumps Another $34B Into Wall Street appeared first on DCReport.org.